Table of Contents

- Executive Summary: 2025 Market Inflection and Key Drivers

- Current Landscape of Turnlery Restoration Consultancy

- Major Players and Official Industry Associations

- Emerging Technologies Revolutionizing Turnlery Restoration

- Market Size, Growth Forecasts, and Investment Trends (2025–2030)

- Client Segments: Heritage Estates, Museums, and High-End Residential Demand

- Sustainability Initiatives and Regulatory Developments

- Skill Shortages, Training, and Certification Programs

- Case Studies: Notable Projects from Industry Leaders

- Future Outlook: Disruptions, Opportunities, and Strategic Recommendations

- Sources & References

Executive Summary: 2025 Market Inflection and Key Drivers

The turnlery restoration consultancy sector is poised for significant transformation in 2025, driven by a confluence of heritage conservation priorities, sustainability mandates, and technological advancements. Turnlery—the craft, preservation, and restoration of lathe-turned wooden objects such as balusters, furniture components, and architectural details—has witnessed renewed attention within both public and private restoration projects. This resurgence is underpinned by government incentives for historic building preservation and a growing preference for authentic, circular-economy solutions in architectural restoration.

Funding allocations and legislative frameworks are expected to accelerate market activity. For example, in the UK, the Historic England organization continues to expand its support for heritage skills and restoration, with specific mention of traditional woodworking and joinery as critical to preserving the nation’s built environment. In the United States, the National Park Service has reaffirmed its commitment to maintaining and restoring historic structures, with turnery restoration consultancy services playing a vital role in projects funded under the Historic Preservation Fund in 2025 and beyond.

Demand for consultancy is also being shaped by technological innovations. The integration of digital scanning, CNC replication, and non-invasive wood analysis is streamlining restoration timelines, improving precision, and reducing costs. Firms such as Festool and restoration workshops using advanced lathing and finishing tools demonstrate the sector’s adoption of high-tech equipment, enhancing both efficiency and the quality of outcomes.

Sustainability remains a key market driver. Major suppliers like Timber Development UK emphasize sourcing certified reclaimed or sustainably managed timber, aligning with client and regulatory requirements for eco-friendly materials. This push towards sustainable practice is expected to further differentiate consultancies with robust environmental credentials, offering them a competitive advantage as clients prioritize green restoration.

Looking forward, the consultancy market for turnlery restoration is forecast to experience robust growth. Ongoing investment in heritage infrastructure, evolving building codes, and an increased focus on skilled craftsmanship will drive demand for expertise. Furthermore, collaborations between consultancies, timber suppliers, and training organizations are anticipated to address emerging skills gaps, ensuring a resilient and adaptive sector. As a result, 2025 marks a pivotal year, setting the stage for continued innovation and expansion in the years to follow.

Current Landscape of Turnlery Restoration Consultancy

The field of turnlery restoration consultancy, which specializes in the preservation and renewal of historical wooden implements and turned objects, is experiencing a resurgence as heritage conservation and sustainable craftsmanship gain prominence. In 2025, several factors shape the current landscape, including growing public interest in historic preservation, advancements in restoration technologies, and a heightened focus on sustainable sourcing.

Across the United Kingdom and Europe, organizations such as Society for the Protection of Ancient Buildings (SPAB) and Historic England have amplified their support for specialist restoration, offering grants and technical guidance for projects involving traditional woodwork, including turnlery. These initiatives reflect a broader trend: the integration of consultancy services into large-scale heritage restoration projects, where experts in turnlery advise on authentic techniques, material selection, and long-term conservation strategies.

Manufacturers and suppliers, including Axminster Tool Centre Ltd and Record Power Ltd, report an uptick in demand for traditional hand tools and heritage-compatible materials. Their product lines now cater not only to hobbyists but also to professional restorers and consultancies seeking period-appropriate solutions. This trend is further supported by organizations like The Worshipful Company of Turners, which promotes the craft through competitions, exhibitions, and educational outreach, fostering a new generation of skilled artisans equipped to support restoration consultancy.

Technology is also reshaping consultancy services. Digital analysis tools, including 3D scanning and non-invasive imaging, are being adopted to assess the condition and provenance of historic turnery, enabling consultants to provide more precise restoration recommendations. Companies such as FARO Technologies Inc. supply advanced measurement devices that are increasingly used in the conservation sector for documentation and planning.

Looking ahead, the outlook for turnlery restoration consultancy is positive. Demand is expected to rise as more heritage sites and private collections prioritize authentic restoration. Sustainability will remain a central concern, with consultancies advising clients on responsible timber sourcing and long-term care. Additionally, the sector is likely to see increased collaboration between heritage organizations, tool manufacturers, and specialist artisans, ensuring that traditional techniques are preserved and adapted for future generations.

Major Players and Official Industry Associations

The turnlery restoration consultancy sector in 2025 is characterized by a blend of historic craft institutions, specialized restoration firms, and professional guilds that support standards and training. As the interest in heritage preservation grows—fuelled by governmental incentives and increased demand for sustainable interior solutions—major players and official associations are shaping the industry’s trajectory.

Among the leading consultancies, The Worshipful Company of Turners, one of London’s historic livery companies, continues to play a pivotal role. Not only does it promote excellence in woodturning, but it also provides a network for restoration professionals, facilitating knowledge exchange and best practices. The company frequently organizes exhibitions and workshops, ensuring the sector remains vibrant and up-to-date with contemporary restoration methodologies.

In the UK, Heritage Crafts Association is recognized as the main advocate and registry for endangered crafts, including turnlery. The association provides consultancy and expertise to restoration projects, connects skilled craftspeople with heritage sites, and campaigns for the safeguarding of traditional turnery skills. Their recent partnership initiatives in 2025 aim to bolster training programs and secure funding for endangered crafts, reinforcing the sustainability of the restoration consultancy profession.

On the manufacturing and commercial side, Axminster Tools has established a dedicated heritage restoration advisory division, offering consultancy services, technical advice, and specialized restoration tools to professionals and institutions engaged in turnlery restoration. Their collaborations with heritage bodies and museums have set benchmarks for tool standards and restoration techniques, with ongoing research into sustainable sourcing and historic accuracy.

In the United States, the American Association of Woodturners serves as the primary industry body, providing education, certification, and networking for restoration consultants. Their 2025 initiatives include digital resource libraries and national restoration workshops, aiming to address the shortage of skilled consultants and standardize restoration processes.

- The Worshipful Company of Turners: Historic guild, network for consultants, training provider.

- Heritage Crafts Association: Advocacy, endangered crafts registry, consultancy.

- Axminster Tools: Restoration advisory division, technical support, tool innovation.

- American Association of Woodturners: US industry body, education, certification.

Looking forward, collaboration between these major players and official associations is expected to intensify, with digitalization, sustainability, and skills transfer at the forefront of strategic development through 2025 and beyond.

Emerging Technologies Revolutionizing Turnlery Restoration

Emerging technologies are rapidly transforming the field of turnlery restoration consultancy, with 2025 marking a notable point of convergence between traditional craft and digital innovation. Consultants specializing in the restoration of wooden turned objects—such as antique tableware, decorative finials, and historical artifacts—are increasingly leveraging advanced tools and materials to enhance both authenticity and efficiency.

One of the most significant developments is the adoption of 3D scanning and digital modeling. High-resolution handheld scanners now allow consultants to create precise digital replicas of original turnery pieces, facilitating detailed analysis and planning for restoration work. These digital models are also being archived by museums and heritage organizations to support future conservation efforts and to assist with public education initiatives. For instance, ZEISS provides metrology solutions that are being adapted for heritage and art restoration, offering micron-level accuracy in dimensional analysis of intricate turned items.

Material science is another area witnessing substantial progress. Consultants are now able to recommend and source advanced adhesives and consolidants that are both reversible and compatible with historic woods—critical for preserving the integrity and value of restored objects. Companies like Conservation Resources supply a range of archival materials and tools tailored for restoration professionals, ensuring that interventions meet both modern conservation standards and traditional aesthetic requirements.

Automated and semi-automated lathes equipped with computer numerical control (CNC) technology are being selectively introduced into workshops, supporting consultants in recreating missing or severely damaged turnery components with high precision. While traditional hand-turning remains central to conservation philosophy, these tools offer significant time savings and reproducibility for non-visible structural elements. Manufacturers such as Laguna Tools have expanded their product lines to serve heritage restoration needs, offering CNC lathes with customizable settings for delicate work.

Looking forward, the integration of artificial intelligence (AI) into the consultancy workflow is anticipated to drive further innovation. AI-powered diagnostic software is emerging, capable of analyzing damage patterns, recommending restoration approaches, and predicting long-term outcomes based on historical and environmental data. Collaborative research between industry bodies like the Institute of Conservation (Icon) and technology developers is expected to refine these tools, making them more accessible to independent consultants and small-scale workshops by 2027.

In summary, the convergence of digital scanning, material innovation, and intelligent automation is setting a new standard in turnlery restoration consultancy. These technologies are enhancing the ability of consultants to deliver historically accurate, sustainable, and efficient restoration solutions, ensuring the continued preservation of cultural heritage for future generations.

Market Size, Growth Forecasts, and Investment Trends (2025–2030)

The turnlery restoration consultancy sector—encompassing advisory services for the conservation, repair, and adaptive reuse of historic wooden turnery (lathe-turned wood elements in heritage buildings and objects)—is poised for notable growth between 2025 and 2030. This trend is primarily driven by increasing global commitments to heritage preservation, government grants for restoration, and rising private investment in the adaptive reuse of historic properties.

In Europe, several national heritage bodies have identified the maintenance and restoration of interiors featuring bespoke turned woodwork as a key conservation priority. For instance, Historic England and similar organizations in France and Germany are investing in specialized training and certification programs for craftspeople and consultants, indicating a steady pipeline of restoration projects through the decade.

On a broader scale, industry data from leading heritage contractors such as Foster & Co. in the UK and Kirby Restoration in the US demonstrates a sustained increase in demand for consultancy services relating to turnery conservation. Both firms report that commissions involving turned timber elements—such as stair balusters, newel posts, and decorative columns—comprise a growing proportion of their annual project portfolios, with year-on-year growth rates in the consultancy segment estimated at 7–10% as of 2025.

Investment in this niche is also being catalyzed by the emergence of sustainable forestry and responsible sourcing standards, as promoted by organizations like the Forest Stewardship Council (FSC). These standards influence the availability and selection of suitable replacement timbers, necessitating expert consultancy to ensure compliance and compatibility with historic fabric, thereby expanding the consultancy’s role.

Outlook for the period to 2030 is robust. Government-backed initiatives such as the UK’s National Lottery Heritage Fund are expected to sustain a high volume of restoration grants, with a notable allocation earmarked for interiors and artisan woodwork. In the private sector, increasing interest from boutique hotels and developers in repurposing heritage buildings is forecast to drive further demand for expert turnlery restoration advice.

In summary, the turnlery restoration consultancy market is set for healthy expansion over the next five years, underpinned by regulatory, economic, and cultural factors. Firms that can demonstrate expertise in both traditional craftsmanship and modern sustainability standards are likely to capitalize on the sector’s projected growth and ongoing investment trends.

Client Segments: Heritage Estates, Museums, and High-End Residential Demand

The demand for turnlery restoration consultancy is evolving, driven by distinct client segments with specialized requirements and high expectations for authenticity and craftsmanship. The principal client groups in 2025 are heritage estates, museums, and high-end residential property owners, each contributing to the sector’s growth and shaping its service offerings.

Heritage estates, including stately homes and historical properties, represent a core client base. These estates often possess extensive collections of original turned woodwork—balusters, finials, newel posts, and decorative mouldings—that require expert restoration to meet conservation standards. In the United Kingdom, organizations such as National Trust and English Heritage continue to invest in the preservation of period interiors and exterior woodwork, commissioning restoration consultants to develop sensitive, sustainable restoration strategies that comply with heritage guidelines. The increasing allocation of public and private funds for heritage conservation in the UK and Europe signals ongoing opportunities for consultancy services in this segment.

Museums form another significant client segment. Institutions such as the Victoria and Albert Museum and the Metropolitan Museum of Art regularly undertake restoration of historic furniture and fixtures to maintain display standards and ensure long-term preservation. Museum clients require turnlery consultants not only for object restoration but also for technical documentation, provenance research, and the provision of training workshops for in-house conservation teams. With museum visitor numbers and endowment funding stabilizing post-pandemic, demand for specialized consultancy is set to remain robust through 2025 and beyond.

The high-end residential market is increasingly engaging turnlery restoration consultants, particularly in urban centres with a stock of period properties. Luxury homeowners and developers seek to preserve or reinstate original wood features as part of bespoke renovations, with a focus on authenticity and sustainable reuse. Companies such as Savills and Knight Frank report rising client interest in heritage features, contributing to a steady pipeline of projects requiring specialist input on sourcing, restoration, and replication of historic turned wood elements.

Looking ahead, the outlook for turnlery restoration consultancy is positive. Regulatory frameworks and growing public appreciation for historic craftsmanship continue to create a supportive environment for sector growth. Digital documentation and advanced restoration techniques are also opening new opportunities to serve these demanding client segments, ensuring that consultancy services will remain integral to the stewardship of historic woodwork in the coming years.

Sustainability Initiatives and Regulatory Developments

The turnlery sector, encompassing the restoration and preservation of wooden objects such as handles, knobs, and decorative pieces, has experienced significant advancements in sustainability initiatives and regulatory frameworks in 2025. Turnlery restoration consultancies are increasingly aligning their practices with environmental targets and legal requirements, both to meet client expectations and to adhere to evolving industry standards.

A key sustainability initiative in 2025 is the broader adoption of certified sustainable timber in restoration processes. Consultancies are prioritizing materials bearing certifications from organizations such as the Forest Stewardship Council (FSC), ensuring that wood used in turnlery restoration is sourced from responsibly managed forests. Furthermore, the Programme for the Endorsement of Forest Certification (PEFC) continues to play a pivotal role in promoting chain-of-custody transparency, with restoration consultants increasingly required to document the provenance of materials used in their projects.

In 2025, regulatory developments are driven primarily by the implementation of stricter controls on the use of hazardous chemicals in wood restoration. The European Chemicals Agency (ECHA) has expanded its REACH regulations, further limiting the use of certain solvents and adhesives that can negatively impact both the environment and occupational health. Restoration consultancies are responding by integrating low-VOC (volatile organic compound) and bio-based products into their processes, which aligns with guidance from leading finish manufacturers such as Osmo UK and Fiddes & Sons Ltd.

Moreover, initiatives to reduce waste and promote circularity are gaining momentum. Turnlery restoration consultancies are increasingly collaborating with organizations like the Wood Recyclers’ Association to recycle offcuts and removed materials, ensuring that as much wood as possible is repurposed rather than sent to landfill. Digital documentation and lifecycle tracking, encouraged by industry bodies such as the The Heritage Alliance, are further supporting transparent and sustainable project management.

Looking ahead, the outlook for turnlery restoration consultancy is shaped by ongoing regulatory tightening and rising demand for traceable, eco-friendly restoration solutions. The sector is expected to see increased investment in research and development of alternative finishes, adhesives, and restoration techniques that minimize environmental impact while preserving the integrity and heritage value of restored pieces. As regulatory bodies and industry associations continue to set higher benchmarks for sustainability, consultancies that proactively adapt to these standards will be best positioned to thrive in the coming years.

Skill Shortages, Training, and Certification Programs

The turnlery restoration sector—encompassing the conservation and repair of traditional wooden turned objects and architectural elements—faces a pronounced skills shortage as of 2025. The craft requires both deep historical knowledge and advanced practical abilities, which are increasingly rare due to the retirement of experienced artisans and limited formal training pathways. According to The Furniture Makers’ Company, the lack of specialist woodturners is a growing concern, with fewer young professionals entering the field and existing experts in high demand for heritage projects.

Significant investment has been channeled into training initiatives to address these shortages. Organizations such as The Worshipful Company of Turners have expanded their bursary and apprenticeship offerings, funding both short courses and longer-term mentorships in traditional turning and restoration. In 2024–2025, the Company’s “Turners’ Training Initiative” enrolled a record number of apprentices, focusing on the transfer of restoration techniques for historic interiors and artefacts. These programs are increasingly partnering with museums and historic estates, such as the National Trust, to provide real-world restoration experience on listed properties.

Certification remains a challenge, as there is no single, universally recognized qualification specific to turnlery restoration. However, efforts are underway to formalize standards. The City & Guilds Institute has piloted modules on heritage woodwork, including elements relevant to turnlery, while the Guild of Master Craftsmen continues to accredit experienced practitioners via peer review. In parallel, leading suppliers such as Axminster Tools increasingly host workshops that incorporate conservation-grade practices, aiming to upskill both hobbyists and professionals.

- By late 2025, the sector anticipates further collaboration between industry bodies and academic institutions to embed restoration skills within broader furniture and heritage craft curricula.

- Digital learning platforms, such as those developed by The Worshipful Company of Turners, are expected to broaden access to specialist knowledge, though hands-on apprenticeship remains central.

- The outlook for the next several years points to ongoing shortages, but also to a gradual strengthening of the training pipeline and increased formal recognition of the turnlery restoration consultancy profession.

Case Studies: Notable Projects from Industry Leaders

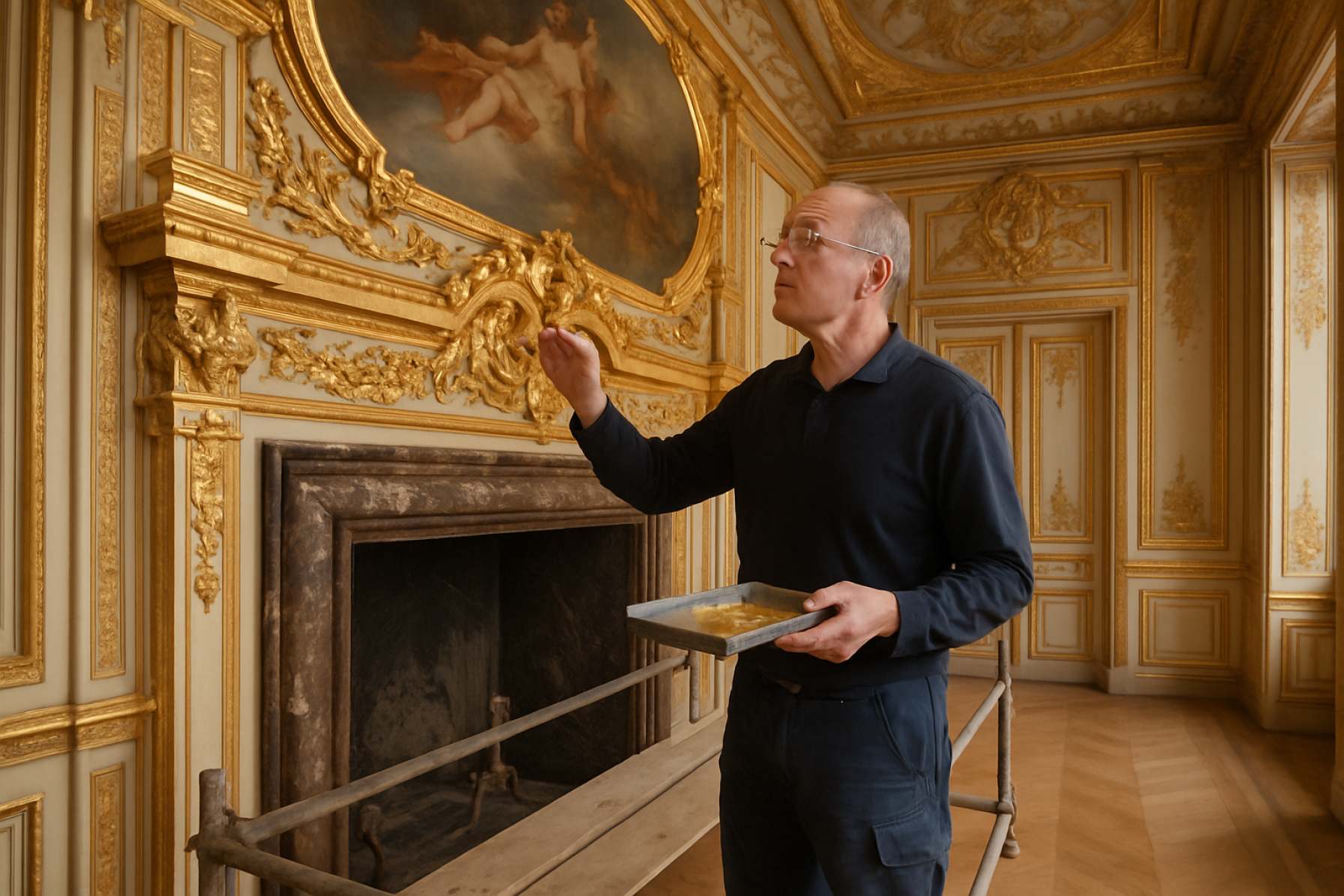

In recent years, the field of turnlery restoration consultancy has witnessed significant advancements, driven by a renewed interest in preserving cultural heritage and traditional craftsmanship. Several industry leaders have undertaken notable projects that showcase innovation, expertise, and community engagement in restoring historical turnlery—ranging from architectural timberwork to restored wooden artifacts.

- The Worshipful Company of Turners has played a pivotal role in the restoration of historic turned woodwork within the United Kingdom. In 2024, they collaborated with regional museums and heritage sites, such as the Museum of London, to restore a series of 18th-century wooden balustrades and ceremonial objects. Their consultancy facilitated the identification of period-accurate materials and finishing techniques, ensuring authenticity in the restoration process. The project’s methodology has since been adopted in regional conservation guidelines.

- Museo dell’Arte della Tornitura in Italy undertook a major restoration of Renaissance-era turned furnishings in 2023-2024, enlisting the expertise of local turnery consultants. By employing traditional hand-lathe methods alongside digital documentation, they achieved both physical restoration and digital archiving of intricate patterns. This dual approach has been recognized as a model for integrating heritage preservation with modern technology by the International Centre for the Study of the Preservation and Restoration of Cultural Property (ICCROM).

- Historic England has advanced several consultancy-led projects in the adaptive reuse of timber interiors in stately homes. Their 2025 guidance documents highlight the restoration of early 19th-century staircases and handrails using advice from turnery restoration experts. The organization’s commitment to sustainable materials and reversible interventions is shaping best practices for ongoing and future projects (Historic England).

- In the United States, National Park Service has overseen the restoration of wooden elements in landmark buildings, such as the 2024 rehabilitation of the historic Old North Church in Boston. Specialist turnlery consultants were brought in to assess deterioration, recommend conservation treatments, and supervise skilled artisans in replicating missing turned details, ensuring compliance with federal preservation standards.

Looking ahead to 2025 and beyond, these projects exemplify a trend toward multidisciplinary collaboration, technological integration, and rigorous adherence to conservation ethics in the turnlery restoration consultancy sector. Industry leaders continue to set benchmarks by publishing transparent project documentation and sharing methodologies, fostering knowledge transfer, and elevating standards across the field.

Future Outlook: Disruptions, Opportunities, and Strategic Recommendations

In 2025 and the following years, the turnlery restoration consultancy sector is poised for notable transformation driven by evolving sustainability mandates, advanced materials science, and shifting market expectations within the woodworking and heritage preservation industries. Several trends and anticipated disruptions are shaping the landscape for consultancies advising on the restoration and conservation of turned wooden objects, such as historic stair balusters, handrails, and decorative fixtures.

- Sustainability and Compliance: The growing emphasis on sustainable forestry practices and the provenance of restoration materials is intensifying. Organizations such as the Forest Stewardship Council and PEFC International continue to update certification standards, impacting sourcing decisions and requiring consultancies to stay current with compliance and responsible material procurement. Anticipated regulatory tightening across Europe and North America will further drive demand for traceable and certified timber in restoration projects.

- Integration of Digital Technologies: Digital scanning and modeling technologies are becoming standard tools in turnlery restoration. Companies like Festool GmbH are integrating digital solutions into woodworking and restoration workflows, improving accuracy in documentation and replication of historic profiles. The adoption of these tools enables consultancies to offer more precise project planning and to minimize material waste—key concerns for both cost and sustainability.

- Skills Transfer and Training: The sector faces a generational turnover, with a shortage of skilled turners and conservators. Initiatives by organizations such as the Heritage Crafts Association are supporting training and apprenticeships, and consultancies are increasingly expected to contribute to knowledge transfer and capacity building within client organizations and local communities.

-

Strategic Recommendations:

- Invest in continuous professional development focused on new digital and sustainable restoration methodologies.

- Establish partnerships with certified timber suppliers and digital tooling manufacturers to ensure access to compliant resources and state-of-the-art technologies.

- Develop advisory services that help clients navigate evolving certification and heritage compliance requirements, such as those promoted by Historic England.

- Promote community engagement and education to build local capacities for maintenance and restoration of historic turnery.

Overall, turnlery restoration consultancies that proactively adapt to regulatory, technological, and demographic changes will be best positioned to capture new opportunities. The sector’s outlook is robust, with growing public and private investment in heritage conservation and sustainable building practices expected to drive demand through 2025 and beyond.

Sources & References

- Historic England

- National Park Service

- Festool

- Timber Development UK

- Society for the Protection of Ancient Buildings

- Axminster Tool Centre Ltd

- Record Power Ltd

- FARO Technologies Inc.

- The Worshipful Company of Turners

- Heritage Crafts Association

- ZEISS

- Conservation Resources

- Institute of Conservation (Icon)

- Forest Stewardship Council (FSC)

- National Lottery Heritage Fund

- National Trust

- English Heritage

- Victoria and Albert Museum

- Metropolitan Museum of Art

- Savills

- Knight Frank

- Programme for the Endorsement of Forest Certification

- European Chemicals Agency

- Osmo UK

- Fiddes & Sons Ltd

- Wood Recyclers’ Association

- The Heritage Alliance

- The Furniture Makers’ Company

- City & Guilds

- Guild of Master Craftsmen

- Museum of London

- International Centre for the Study of the Preservation and Restoration of Cultural Property (ICCROM)